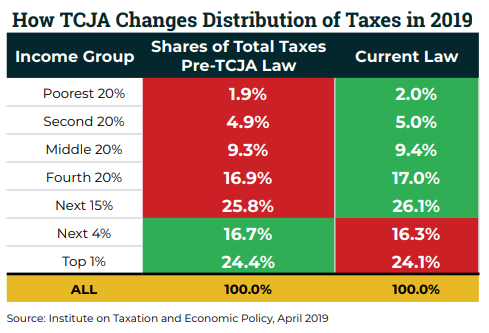

T19-0026 - Tax Benefit of the Earned Income Tax Credit, Baseline: Current Law, Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2019 | Tax Policy Center

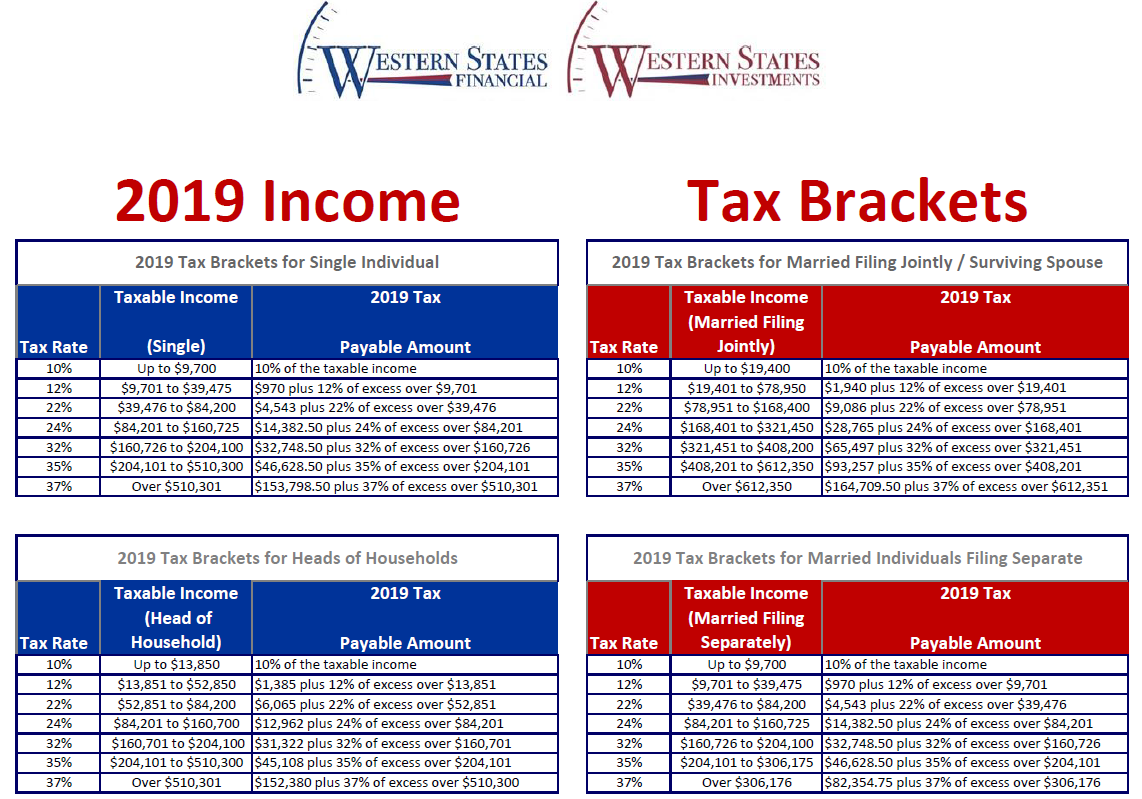

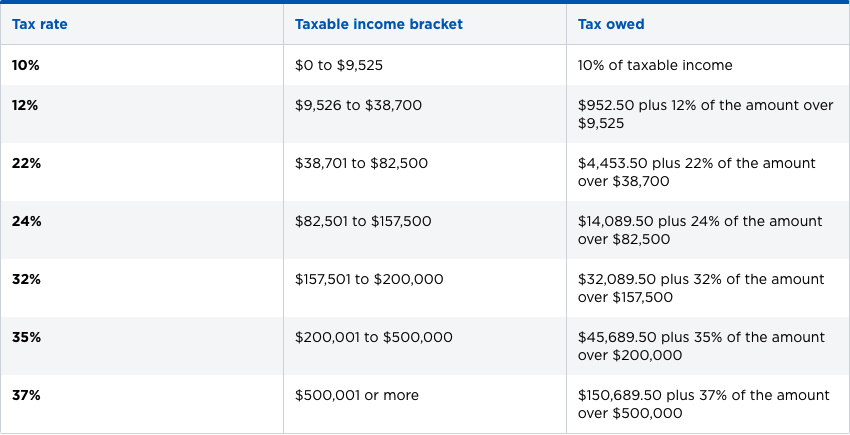

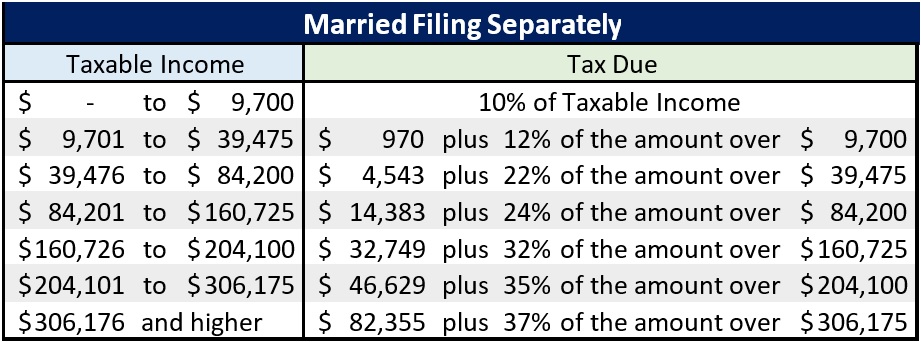

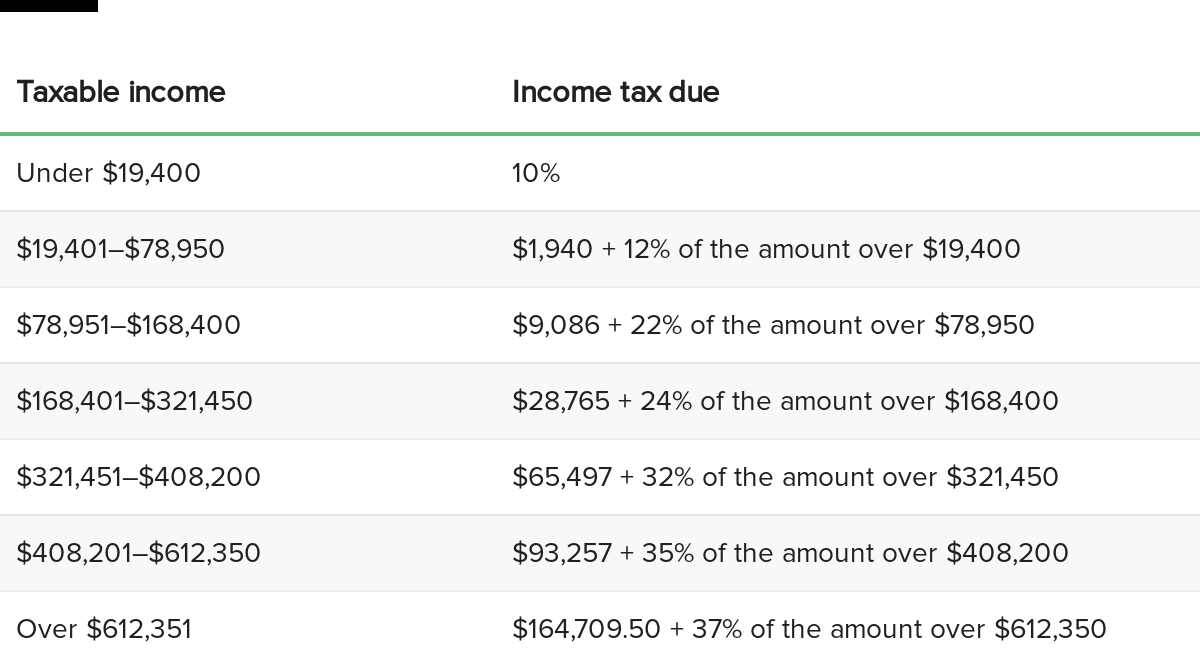

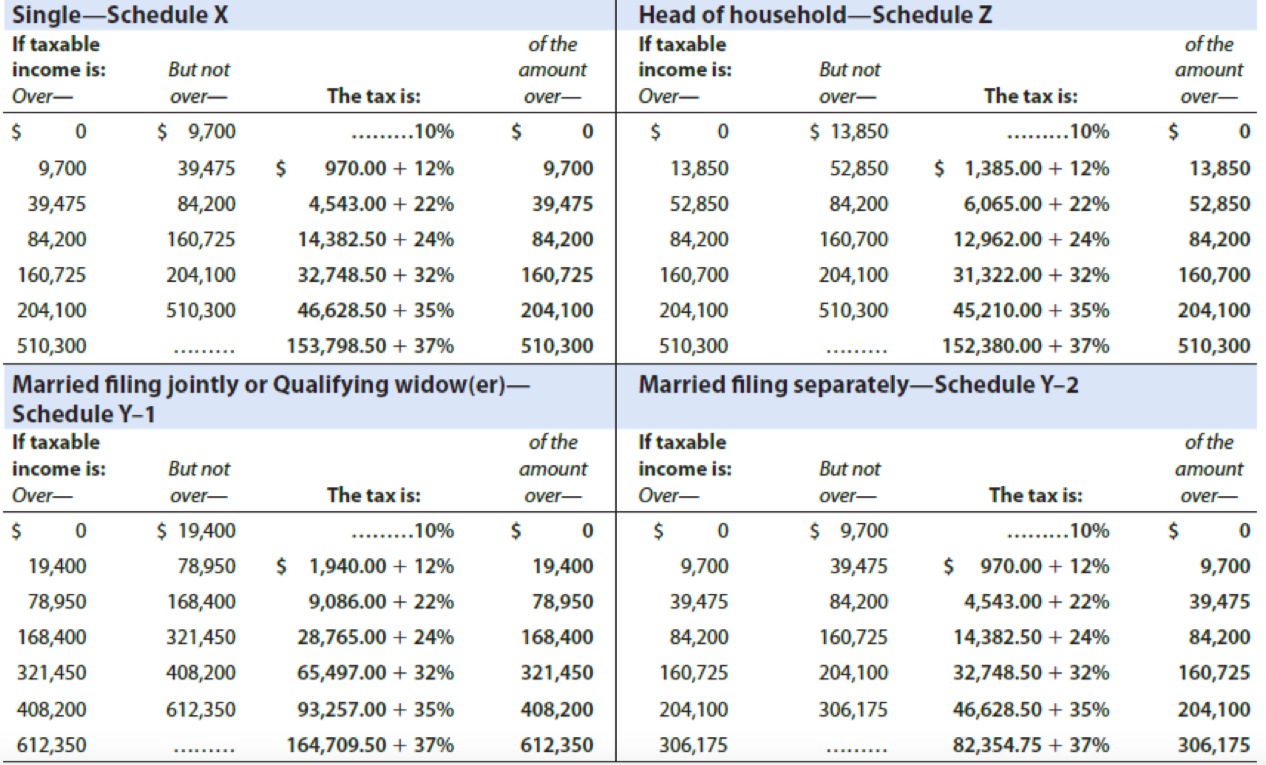

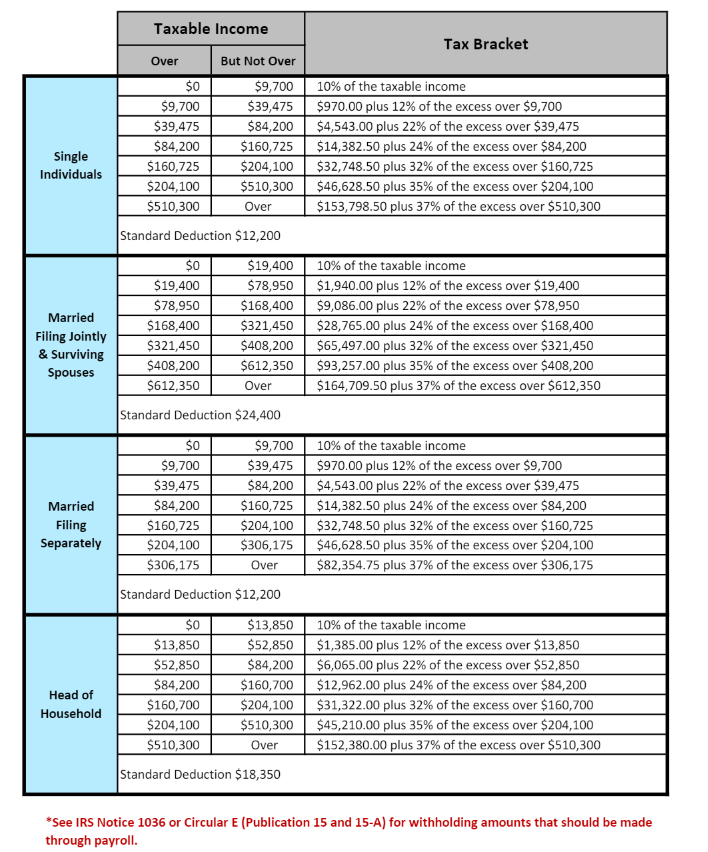

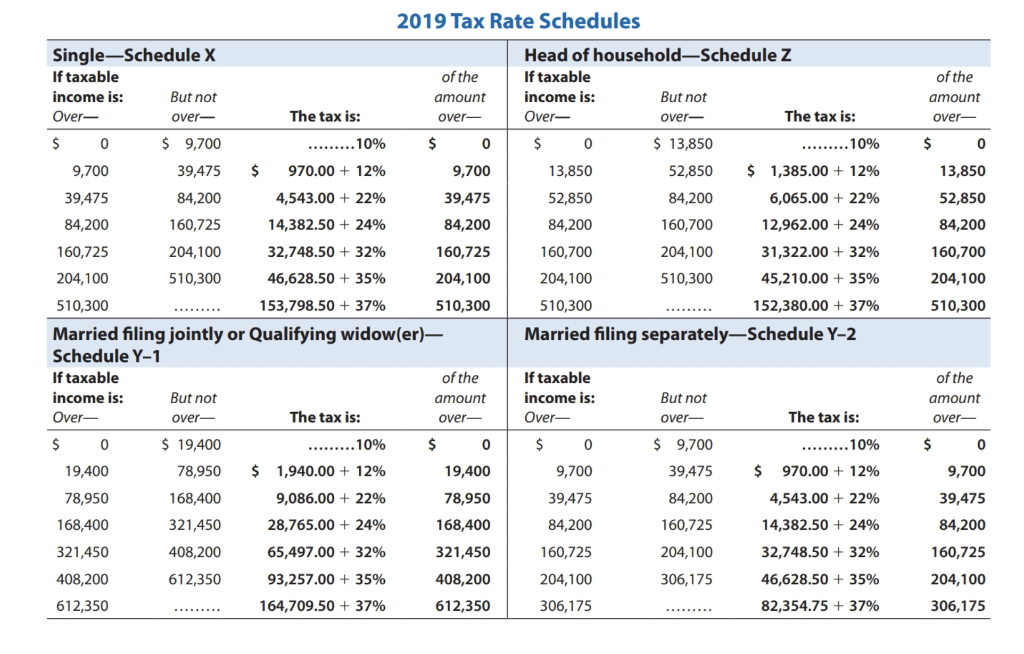

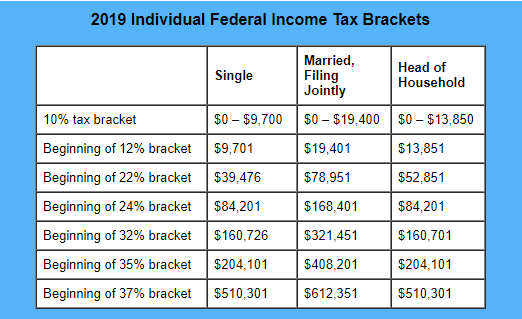

Michigan Family Law Support - January 2019 : 2019 Federal Income Tax Rates & Brackets, Etc., and 2019 Michigan Income Tax Rate and Personal Exemption Deduction - Joseph W. Cunningham, JD, CPA, PC